AltFi wants us to say what we think about tighter regulation – we think it’s more important to say what our customers think.

So here’s a follow-up to our blog of 28th September, and in response to this AltFi article on 8th October.

The useful and informative AltFi website – fast growing into the oracle of the alternative and digital finance industries – has reproached FinTech companies such as ours for “timidity” in the face of the FCA proposals to tighten regulations – in particular, to limit the amount that “unsophisticated” or first time investors can invest. It says we should have galvanized our investors to sign their ‘Trust the Investor’ petition.

Perhaps so, but it’s not a good look for an industry to cry “foul” at the first signs of a professional framework being put in place. Responsible platforms, who are meticulous in the way they conduct business on behalf of their investors, should welcome regulation that brings the less stringent operators up to their own standards. We’d rather the playing field was levelled from the top, because improving practices (and the resultant public perceptions of our industry) benefits all of us. Rogue operators benefit no-one, and they should be forced to pull up their socks or bow out.

So we didn’t feel it our place to take umbrage at the proposals. Our opinion is hardly relevant. What is relevant, however, is the opinion of those who invest their hard-earned nest eggs into platforms such as ours. Do they feel their money is secure? Do they feel they’re fully informed of the risk involved? Are they sufficiently updated?

And – most important of all – do they feel the need for the FCA to further protect them against P2P practices?

This, we felt, was an ideal opportunity to canvass the opinions of CapitalStackers investors. How do they feel we’re doing, and do they want for more tightening? It appears not.

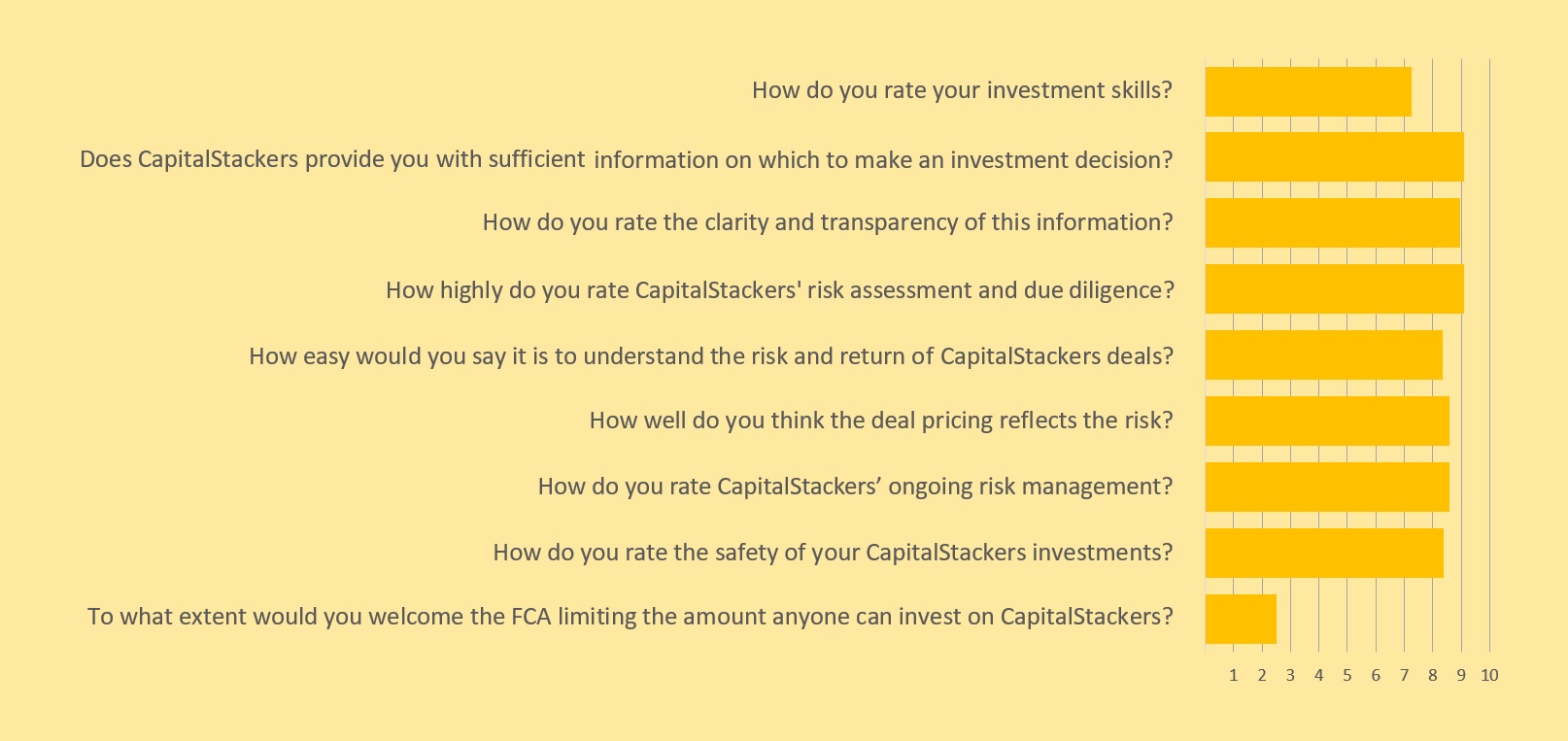

We were pleased to see that our investors gave us an average score of 9 out of 10 when asked to rate the information we provide, our risk assessment, due diligence and our clarity and transparency. Our risk management deal pricing and general security were scored at an average of 8.5.

However, when asked to what extent they would welcome the FCA limiting the amount they could invest, the score came in at an average of 2.5.

But it’s not for us to put words into our investors’ mouths. We’ll let them tell you what they think of us in their own words.

Here are the responses we received to our questionnaire. The comments are anonymous, and we’ve edited one or two for length, but we’ve left them exactly as they were submitted, warts and all:

| I totally oppose the FCA limiting the amount that anyone can place with CapitalStackers without taking the advice of an IFA….The fact here is that CapitalStackers carries out due diligence on all projects handled, and only when satisfied with the outcome of same, then moves a deal forward providing detailed information to its investors. |

| I think CapitalStackers explain the risks and rewards well. There is no requirement for the FCA to become too involved. |

| I trust CapitalStackers to invest wisely. |

| I think the website could be made slightly more user friendly and make it easier to find important information, perhaps a side bar explaining each area and how to locate that info. As regards the FCA limiting the amount people can invest, that must depend on how sophisticated each investor is and whether they fully understand the risks involved. In that respect, perhaps there should be some examples of what can go wrong with a property loan and a worst case scenario potential loss situation. |

| If the FCA does decide to limit the amount people can invest, 10% is too low. 20% or 25% would be better. However, as a sophisticated investor, I have been cautious anyway and not invested more than 10% of my portfolio. Once the channel and Capitalstackers have proved themselves and loans have been repaid with the agreed interest, I will invest a greater proportion of my portfolio, though still maintaining a good mix of asset classes. |

| I would not describe myself as a sophisticated investor, but I always believed that the whole point of peer to peer investments was that it enabled people like me to participate in investing directly compared to other types of investment from which we are excluded. I started investing in peer to peer about 12 months ago and I have been pleased with the outcome so far. I had absolutely no previous knowledge or understanding and carried out my own research before committing any money to investments on peer to peer platforms. I avoid any platforms that do not appear transparent or are too complicated to understand. I am capable of making my own judgement on this and do not need the government to take control of my investment decisions. I should add that in spite of the fact that my knowledge and understanding has been acquired through my own research and I am definitely NOT a professional or even greatly experienced at investing – the ONLY time I have ever lost money was by following the advice of a financial adviser. Since that time I have ‘gone it alone’ and over the past few years I have successfully increased my capital through investments that have been entirely my own choice. |

| I invest with confidence in CapitalStackers. They have a very experienced team in both finance and building development. As they are very selective in their choice of investment deals and, from my own experience, I’ve found CapitalStackers to be meticulous and diligent, I would not agree with limiting the amount one can invest. It should be a personal choice. |

| As an experienced investor and owner of a commercial property portfolio [I am] very comfortable with proportionate risk and due diligence by CapitalStackers. The individuals involved in CapitalStackers have my complete confidence and for that reason I am happy to keep investing. |

| I think the FCA should spend time checking that p2p websites are providing transparent and accurate deal information so that investors can make properly informed decisions, rather than trying to dictate what people invest in them. |

| This type of funding seems very transparent and well explained compared to others. |

| Well run peer to peer funder which understands its market |

| Most investments carry risk and an individual has to take responsibility for his/her decision. |

| I know what I am doing and don’t need to be nanny-ed by an organisation that was unable to spot the last financial crash. |

| It’s not up to the FCA to determine what clients do with THEIR money. All they should be doing is providing the right framework, governance and controls. |

| I like the CapitalStackers model as second charge funding for developers, alongside (though behind) mainstream lenders. The info available is very extensive & thorough. Actually, I would like to invest MORE in CapitalStackers, but opportunities are few and far between and often fill quickly – literally sometimes within minutes of release. |

| Restricting P2P access for retail investors strikes at the heart of the concept of the innovation of a market by the people for the people. FCA role should be to police the platforms to ensure high standards and enable market choice for investors. |

| As usual the controlling body, rather than addressing the real issue, is trying to abdicate responsibility by yet more layers of bureaucracy. The best way for the FCA to protect the investor is to investigate the poorly operated providers and apply severe sanctions and penalties and, where necessary, withdraw authorisation. It is the responsibility of the FCA to do this, not restrict the investment options of individuals in a free market economy. If the FCA had confidence in their own regulatory regime and their policing of the businesses falling within it, a more obvious methodology to protect smaller investors would be to extend the financial compensation scheme to cover this sector. Assuming this is done at the same time as policing the whole sector effectively and weeding out the providers who fail in the Financial Times article this would reduce the risk to smaller investors at the same time as boosting the businesses who are operating as responsibly in this sector as any other mainstream investment falling within the FC scheme. |

| Limiting the amount invested by regulation is unnecessary. The advice currently given, (10% until familiar) is sufficient. |

| I’m more than happy to invest my money through Capitalstackers. The information they provide me allows me to assess the risks as thoroughly as possible. Armed with such information it is up to me whether I invest or not. It is also up to me how much I invest. It is my responsibility and the buck stops with me. The FCA should ensure points 1 to 4 of the blog are met by all P2P platforms. |

| CapitalStackers is a very highly professional p2p platform and by investing in construction loans, I know the associated risks which are also explained on the platform. CapitalStackers’ risk assessment allows me to choose between loans by having the relevant and detailed information about them. Returns are high but CapitalStackers provide a very detailed illustration about the investments’ features and the entailed risks. There are only two things I complain about: the first is the limited numbers of available loans and the second is the entry level of £5000. I would prefer £1000 in order to have a better diversification. |

| The detail of your dealing room is exceptional. There is a learning process to understand the CapitalStackers offering but once understood it is, in my experience as a lender, excellent. |

| Regular updates provide clarity and reassurance, very detailed information provided. |

Don’t invest unless you’re prepared to lose all your money. This is a high risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 minutes to learn more.